FINANCING

Get the machines you need today with manageable payments through our trusted financing partners. Financing helps preserve your cash flow while allowing your shop to grow with confidence.

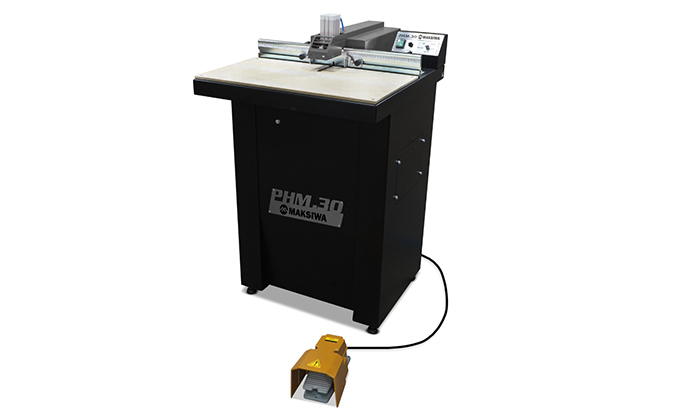

SLIDING PANEL SAW

EDGEBANDER

BORING MACHINES

EDGE TRIMMER

FINANCING

Choose the Financing Partner That Fits Your Business

We focus on small business financing for customers with credit scores between 550-700. Applications are welcome from all credit profiles, including new and start-up businesses.

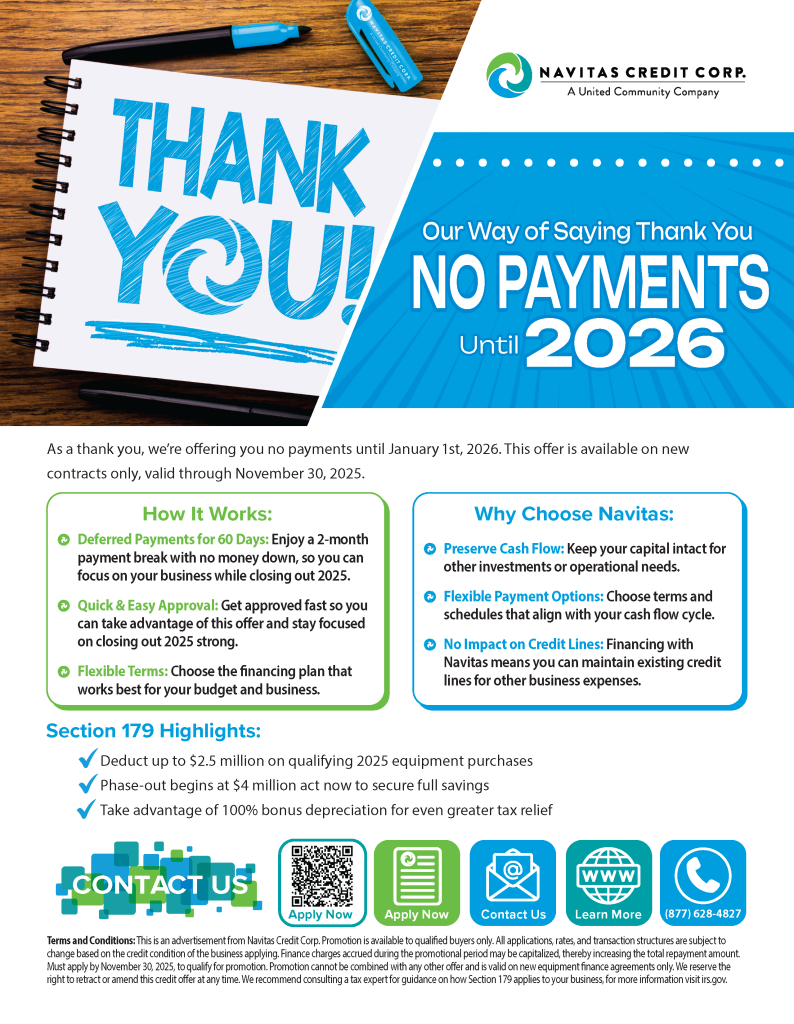

We are affiliated with Navitas. Navitas, a direct lender, offers competitive loan options, start-ups welcome, and flexible terms from 12-72 months to fit your needs!

We are affiliated with Geneva Capital. With Geneva Capital, you may finance in up to 60 months when approved.

We are affiliated with Ascentium Capital. Fast. Flexible. Financing. Aquire the complete Solution with flexible payments.

SECTION 179

Take Advantage of Section 179 Tax Benefits

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment in the year it is purchased or financed.

This means you may be able to reduce your taxable income while upgrading your shop with new Maksiwa machinery.

It’s a government incentive designed to encourage businesses to invest in equipment and grow their operations.

Always consult with your tax advisor to determine eligibility and how Section 179 applies to your business.